can you go to prison for not filing taxes

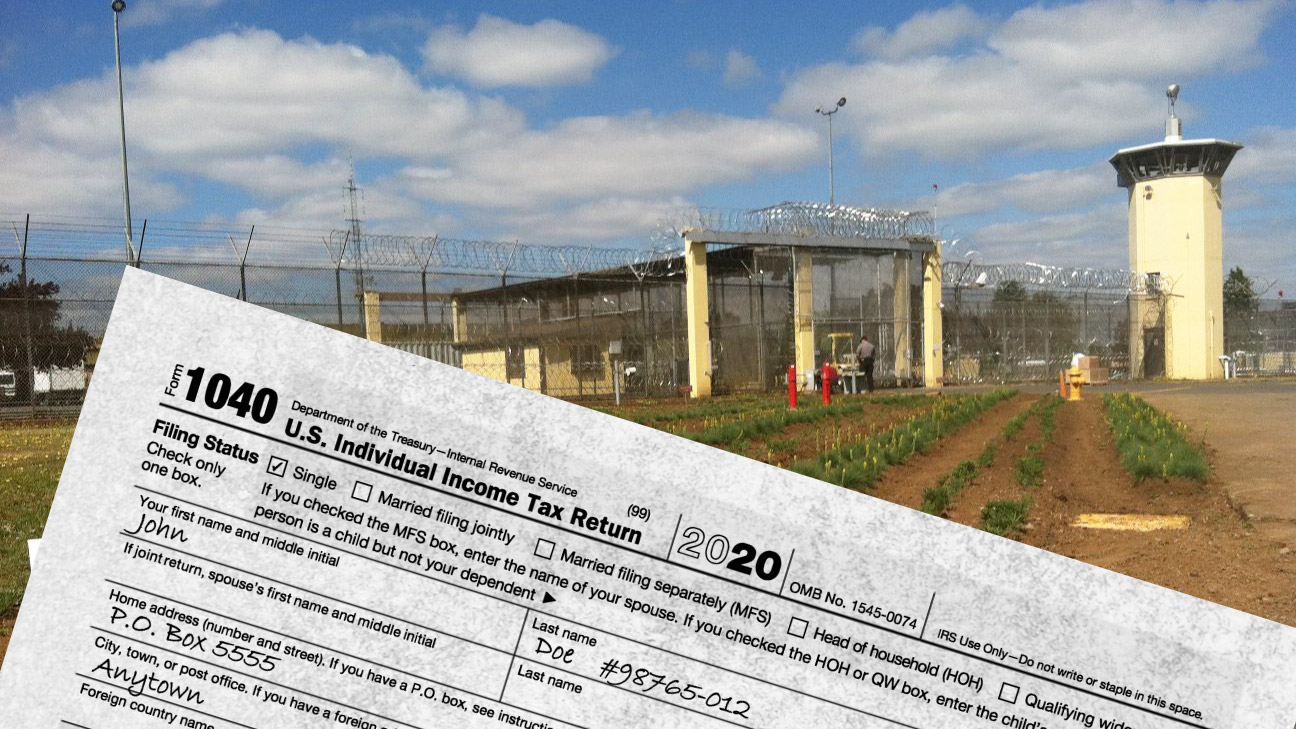

Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen. Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen.

What Could Happen If You Don T Do Your Taxes

The maximum penalty for income tax evasion in the UK is seven years in prison or an unlimited.

. If you owe taxes and do not file a tax return it is a crime. To better understand these distinctions lets take a closer look at when you risk jail time for failing to. Not only does the court order the person to pay the money owed plus.

In 1954 Joseph Nunan Jr. The IRS doesnt go after many people for tax evasion but when they do the penalties are harsh if they are convicted. You can go to jail.

Receive a federal tax lien The IRS may place a lien a legal claim on. In general no you cannot go to jail for. The IRS can pursue collection action liens levies seizures etc in pursuit of the unpaid tax but you may also face misdemeanor charges and a penalty of up to one year in jail and up to a.

The IRS will charge a penalty for failing to file taxes. The total penalties for filing taxes late is usually 5 of the tax owed for each month or part of a month that your return is late up to five months 25. Fail to file their tax returns Failing to file your tax returns can land you in jail for up to one year for every year that.

So there are a number of. The penalty for not filing taxes depends on whether you owe taxes to the IRS. If your return is over 60 days late the.

If you dont file federal taxes youll be slapped with a penalty fine of 5 of your tax debt per month that theyre late capping at 25 in. It is possible that you could go to jail for failing to file your taxes but it will depend on your own personal circumstances. You may even face wage garnishment or property seizure.

Oftentimes youll be subject to tax penalties which will run you a pretty penny at up to 50 of your unpaid tax amount. Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to 20000. The following actions can lead to.

According to FindLaw the IRS recognizes several crimes related to tax evasion. How long can you go to jail for not filing taxes. Income tax evasion penalties summary conviction is 6 months in jail or a fine up to 5000.

Ad Owe back tax 10K-200K. The state can also require you to pay your back taxes. By never filing taxes at all you might be convicted of tax evasionwhich could amount to five years.

Failure to File a Return. Not filing a tax return with the IRS is punishable by one year in prison for each year you fail to file. Could you go to prison for not filing a tax return.

Owing back taxes can be the result of failing to file a tax return filing a return but not paying the tax amount you owe or not reporting all income for a specific tax year. Failing to file a return can land you in jail for one year for each year you didnt file. Whether a person would actually go to jail for not paying their taxes depends upon all.

The short answer to the question of whether you can go to jail for not paying taxes is yes. So lets take a deeper look at this. The IRS may place a penalty of 5 on the tax owed up to five months if you do not file your taxes up to a maximum of 25.

If the IRS feels you are guilty of tax evasion it can file criminal charges against you. Bay Area Tax Attorney.

What To Do If You Did Not File Taxes How To Avoid Major Penalties

Second New Jersey Man Facing Prison Time For Not Paying Taxes

Is Jail A Possibility If You Fail To Pay Your Taxes Frost Law Maryland Tax Lawyer

What Is The Penalty For Late Filing Of Itr For Ay 2022 23 Times Of India

Prisoners Eligible For Stimulus Checks But Getting Payout Behind Bars Is Complicated Opb

What Happens If You Don T File Taxes Is Not Filing Taxes A Crime Legalmatch

Itr Verification Forgot To Verify Your Income Tax Return Here Is What You Can Do The Economic Times

Can I Go To Jail For Unfiled Taxes

Can You Go To Jail For Not Paying A Medical Bill Law Zebra

Is Jail A Possibility If You Fail To Pay Your Taxes Frost Law Maryland Tax Lawyer

Was Lauryn Hill Singled Out Among Tax Evaders

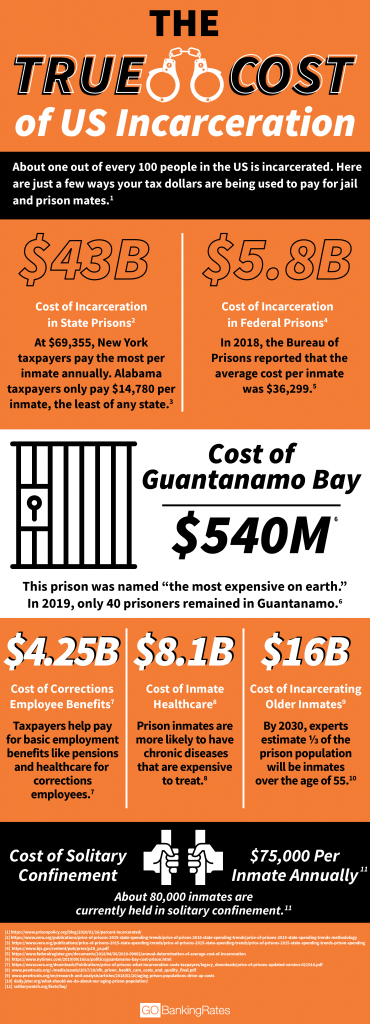

How Much Do Taxpayers Pay For Prisoners Gobankingrates

Will I Go To Jail If I Refuse To Pay War Taxes National War Tax Resistance Coordinating Committee

What If I Did Not File My State Taxes Turbotax Tax Tips Videos

Wesley Snipes Who Was Jailed For Failure To File Taxes Claims Trump Avoided Tax Because Of Who He Knows The Independent

Can You Go To Jail For Not Filing Taxes For 10 Years Quora

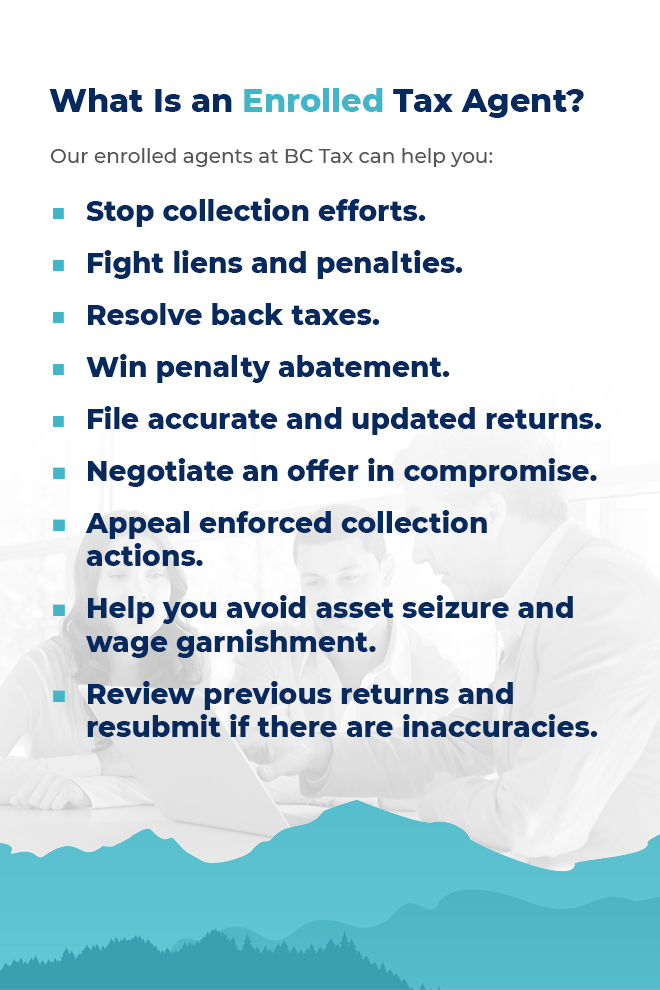

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

What Should You Do If You Haven T Filed Taxes In Years Bc Tax